Three-Speed Europe

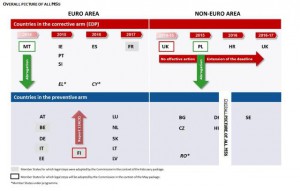

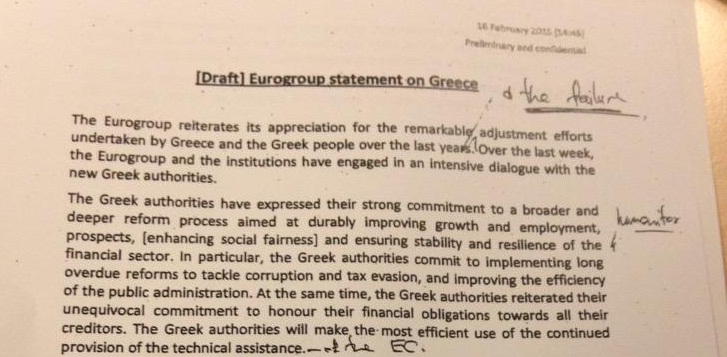

Spain is accelerating, Germany is slowing down, and Greece is in reverse. Gross Domestic Product (GDP) in the entire euro area grew by 0.4% in the first quarter, one tenth more than in the last quarter of 2014, according to Eurostat’s first estimate. However, this figure from the EU’s statistics office conceals a disparity in the performance of the different economies in the region. Low oil prices, the depreciation of the euro against the dollar, and the debt purchase programme, coupled with the low interest rates spurred by the European Central Bank’s (ECB) monetary policy have been the main factor which has benefitted the Eurozone’s economy. But the ECB has warned that the recovery will not be sustainable unless governments work harder with reforms.