The European Commission has upped its growth forecasts for the Eurozone and the entire EU after noting the positive effects of the European Central Bank (ECB) debt purchase programme; cheaper oil prices, and the depreciation of the euro. However, this economic improvement will not be uniform across all the member states.

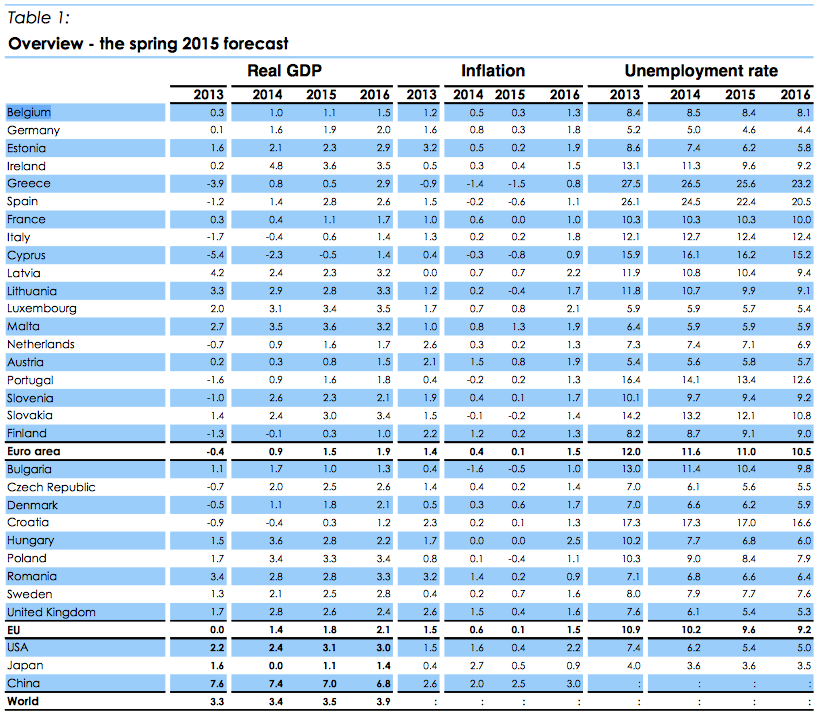

Gross Domestic Product (GDP) for the 19 euro members will be up this year by 1.5%, two tenths higher than estimated in February by the EU executive. “Tailwinds are helping the recovery” according to Brussels. For the 28 countries in the European Union, the Commission also revised forecasts upwards by one decimal point to 1.8%, with domestic consumption as the main engine of the economy.

“The European economy is enjoying the brightest spring for several years, with an upswing backed by external factors and policy measures which are beginning to bear fruit,” remarked the Commissioner for Economic Affairs Pierre Moscovici.

This is an engine that has been fuelled by QE (quantitative easing) – an ECB public debt purchase mechanism of €1bn – which is “having a significant impact” on the financial markets and the economy, according to the Spring report from the Commission. Furthermore, the 35% fall in the price of crude oil over the past year has given impetus to consumer buying power and business investment in Europe, as a net importer of oil. Similarly, exporting countries have benefitted from a 20% euro depreciation against the dollar.

The Commissioner for Economic Affairs, Pierre Moscovici, said “the European economy is enjoying the brightest spring for several years, with an upswing backed by external factors and policy measures which are beginning to bear fruit. But more is needed to ensure that this recovery is more than just a seasonal phenomenon. Meeting reform and investment commitments and adhering to responsible tax policies is key to sustainable growth and the jobs that Europe needs.”

While the report shows that the Eurozone is recovering, in 2016, France, the second largest economy in the region, will not grow as quickly as expected by Brussels three months ago: now only 1.1%. Italy, the euro’s third power block, will see increased debt, growing by a mere 0.6% this year.

The economic upswing will be uneven between the different European partners. Germany, for example, will enjoy an unemployment rate of only 5%, while Greece will have to endure 25% unemployment. The most advanced economies in the North will see trade surpluses of 8%, while deficits will be concentrated in the South.

Brussels is projecting one of the most optimistic revisions, although not as positive as the one in the last Stability Programme update released by Mariano Rajoy’s government on Friday.

The Commission estimates that the Spanish economy will grow 2.8% this year, five decimal points higher than forecast three months ago. Unemployment remains the unfinished business, not falling below the 20% mark, this year or next year, which is roughly twice the European average.

Greece’s GDP is showing signs of the lack of agreement with its creditors

The Commission has slashed its growth forecast for Greece from 2.5% down to 0.5% at a time when the Alexis Tsipras government is trying to persuade its European partners to help them meet their financial obligations and avoid default.

“The current lack of clarity in the political orientation of the government vis-à-vis its policy commitments, within the context of the EU/IMF support mechanisms, further worsens the uncertainty” said the European Commission in its Spring report.

The Commission has slashed its growth forecast for Greece from 2.5% down to 0.5% at a time when the Alexis Tsipras government is trying to persuade its European partners to help them meet their financial obligations and avoid default.

Greece is hoping to reach an agreement with its creditors on the structural reforms they demand in order to receive a final tranche of €7.2bn which Greece desperately needs to repay the loans from the International Monetary Fund (IMF) and the ECB in the coming months. Nevertheless, Brussels hopes that Greece will recover and that its GDP will grow by 2.9% in 2016.

The European Commission expects Eurozone inflation to start picking up, thus avoiding the deflation predicted in February. Even still, this will stick below the ECB’s target of just under 2% for both 2015 and 2016.