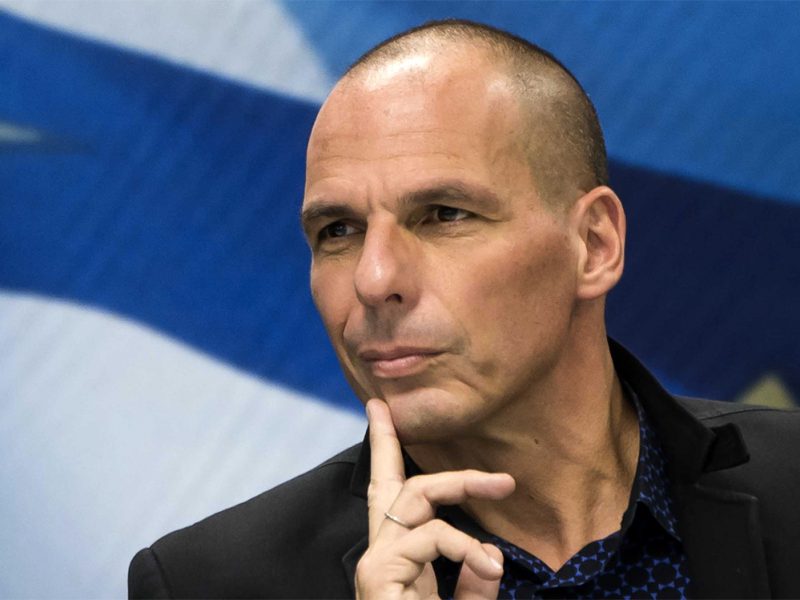

Plan B: A Parallel Banking System Devised by Yanis Varoufakis

![]()

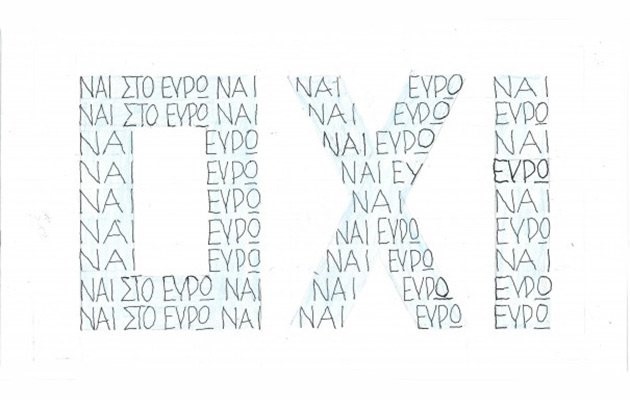

Much has been debated about the Plan B that would lead Greece into previously uncharted waters of a so called ‘Grexit’. The Alexis Tsipras-headed government had the very same scenario prepared, according to the ex-finance minister Yanis Varoufakis, who led the negotiations with the Eurozone leaders and the “Institutions”. Varoufakis, in a teleconference call on July 16, alleged that his boss had given him the go-ahead to create a parallel banking system.